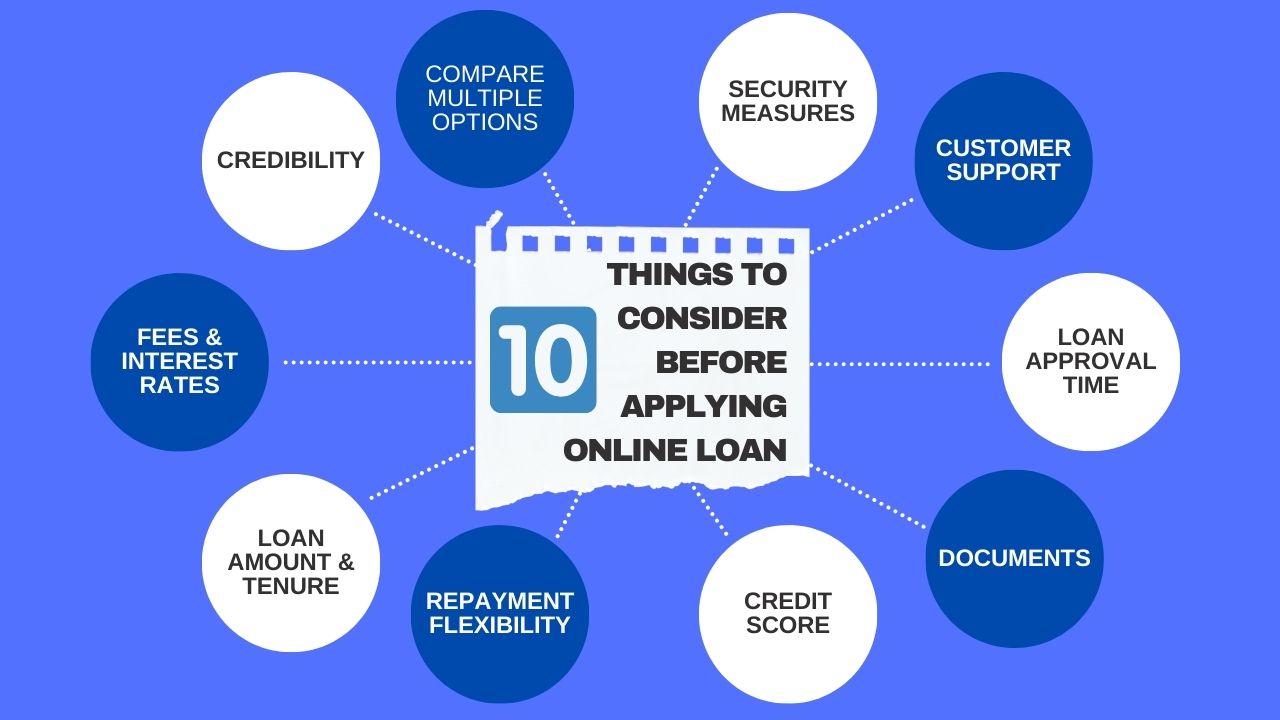

Top 10 Things to Consider Before Applying For a Personal Loan Online in Malaysia

In today’s fast-paced digital era, the convenience of online financial services has become increasingly appealing, especially when it comes to personal loans. Malaysia has witnessed a huge increase in the popularity of online loan applications. While the ease of access is undeniable, potential borrowers must exercise caution and conduct thorough research before committing to an online personal loan. In this article, we will look at the top things to consider before applying for a personal loan online in Malaysia.

1. Credibility of the Lending Platform

Before initiating the loan application process, a thorough evaluation of the online lending platform’s credibility is vital for a secure financial transaction. For banks offering personal loans, verifying their registration with Bank Negara Malaysia (BNM) is a critical step to ensure adherence to stringent regulatory standards. BNM’s oversight guarantees that the bank operates within the legal framework, safeguarding the interests of borrowers.

On the other hand, for non-bank credit providers such as EM Loan, a pivotal aspect of credibility lies in checking licensing with the Ministry of Housing and Local Government (KPKT). This verification process ensures that the credit provider adheres to the rules and regulations set by the government. It assures borrowers that they are engaging with a legitimate and authorized lending entity. The involvement of KPKT adds an additional layer of scrutiny specific to credit providers, emphasizing the importance of due diligence in the online lending landscape.

In addition to regulatory validation, potential borrowers should delve into customer reviews and testimonials too. Reviews from individuals who have already been involved in the lending process with the platform can provide invaluable information. The firsthand experiences of previous borrowers shed light on the platform’s customer service and overall reliability. This approach to assessing credibility allows individuals to make informed decisions by selecting a lending platform that can deliver a trustworthy borrowing experience.

2. Fees and Interest Rates

A careful examination of associated fees and interest rates is important for making informed financial decisions. While online lenders often offer competitive interest rates as a key selling point, borrowers must study these rates carefully to grasp the complete picture of their financial commitment.

Whether it is a fixed rate or a variable rate, each has distinct implications for the borrower’s repayment strategy. Fixed rates provide stability by allowing borrowers to predict monthly repayments accurately, while variable rates can lead to fluctuations that might impact budgeting. Regardless of the type of interest rate, borrowers also need to take note that the maximum interest rate for any unsecured loans in Malaysia is 18% per annum. In short, any entity that offers a loan with an interest rate higher than 18% per annum is considered unlawful.

Beyond interest rates, borrowers must also read the terms and conditions carefully to uncover any hidden charges. Some online lenders may levy late payment fees or prepayment penalties. Be extremely cautious especially when certain fees are charged upfront. These upfront fees can significantly impact the overall cost of borrowing. It is important for borrowers to be aware of these additional costs to calculate the true affordability of the loan and avoid surprises.

3. Loan Amount and Tenure

Determining the loan amount is a critical first step when applying for a personal loan online. Assessing your financial needs allows you to gauge the precise amount to meet your objectives, whether it is to consolidate debts or fund a major expense. While it might be tempting to borrow more than necessary, it is essential to resist the urge to prevent overextending your financial commitments. A disciplined approach ensures that you borrow an amount that serves your purpose without burdening you with unnecessary debt.

Another important consideration is the loan tenure. It is the duration over which you commit to repaying the borrowed amount. The tenure can influence both the total interest paid and the monthly repayment amount. Opting for a shorter tenure can result in higher monthly payments but lower overall interest costs. On the other hand, a longer tenure may offer more manageable monthly payments but may incur higher interest expenses over time. Striking the right balance between loan amount and tenure is important. By aligning the loan amount and tenure with your actual needs, you not only fulfill your objectives effectively but also create a sustainable repayment plan that fosters long-term financial well-being.

4. Repayment Flexibility

When considering an online personal loan, it is important to study the repayment options offered by the lender. The flexibility of repayment terms can significantly impact your borrowing experience. Many online lending platforms recognize the different financial situations of their borrowers and offer flexible repayment schedules to accommodate varying needs.

Some lenders allow borrowers to customize their repayment dates. This flexibility empowers borrowers to manage their cash flow effectively, reducing the likelihood of missed payments and associated penalties. Additionally, some platforms permit early repayments without imposing penalties. It provides borrowers with the opportunity to reduce interest costs and accelerate debt repayment. Rather than being bound by rigid payment structures, borrowers can leverage flexible repayment options to navigate temporary financial setbacks without undue stress.

Always remember to familiarize yourself with the terms and conditions about early repayment. While paying off your loan ahead of schedule may seem a wise decision, it is essential to be aware that some lenders impose penalties or fees for doing so. These penalties can negate the potential savings from early repayment and result in unforeseen costs that may impact your overall financial plan.

Besides, read the terms carefully to see if there are any procedures or steps that you need to do before settling your loan early. Some lenders may require borrowers to write letters or fill in the necessary forms to act as letters of notification. Understanding the specific terms related to early repayment allows you to make informed decisions regarding your loan repayment strategy.

5. Credit Score Requirements

In the Malaysian context, online lenders commonly evaluate loan applications based on credit scores. These scores can reflect individuals’ creditworthiness and their ability to repay loans. One crucial aspect to consider before applying for a personal loan online is understanding the minimum credit score requirements set by the chosen platform. Different lenders may have different thresholds, with some prioritizing higher credit scores as an indicator of lower lending risk. To ensure a smoother application process, prospective borrowers should check whether their credit score meets the lender’s criteria.

In Malaysia, credit reports are managed by entities such as the Central Credit Reference Information System (CCRIS) and Credit Tip-Off Service (CTOS). These systems compile individuals’ credit information, including repayment history, outstanding debts, and credit utilization. Before applying for a personal loan online, it is advisable to obtain a copy of your credit report to assess your current financial standing. Reviewing your credit report allows you to identify any areas for improvement that could affect your credit score. If your credit score falls below the lender’s specified threshold, you should take proactive steps to enhance your creditworthiness, such as settling outstanding debts or rectifying errors in your report. These steps can increase your chances of loan approval and secure more favourable terms.

6. Documents Requirements

In addition to meeting eligibility criteria and credit score requirements, borrowers should also pay close attention to the documentation required for the online loan application process. Each lender may have specific documentation requirements and submission methods. You must make sure that you have all the necessary documents ready before applying for a loan to reduce unnecessary delays.

Typically, common documents requested by online lenders in Malaysia include proof of identification (MyKad), proof of income (salary slips or bank statements), and proof of residence (utility bills). Some lenders may also require additional documents, such as income tax returns or employer verification letters. By familiarizing yourself with the documentation requirements of the chosen lender and preparing these documents in advance, you can streamline the application process and increase the likelihood of approval. Additionally, make sure the provided documents are accurate and up-to-date. This can enhance the credibility of your application and instill confidence in the lender regarding your financial stability.

7. Loan Approval Time

When opting for an online loan, the efficiency of the approval process is often a key consideration for borrowers, especially for those seeking quick access to funds. While the approval process is pretty convenient and fast for most online lenders generally, the turnaround time for loan approval and disbursement may vary among different online lenders.

It is important for borrowers to evaluate the loan approval timeframes of various online lending platforms to choose one that aligns with their urgency. Some lenders offer instant approval capabilities by leveraging automated systems to assess loan applications and provide immediate decisions. On the other hand, certain lenders may take a few days to process loan applications. They will conduct more thorough assessments or manual reviews before reaching a decision. While a longer approval timeframe may entail some waiting, it may also result in more favorable terms or higher loan amounts for borrowers with complex financial profiles. Ultimately, choosing a platform with an approval process that matches your urgency ensures a seamless borrowing experience tailored to your needs.

8. Customer Support

Since online lending involves financial transactions that are conducted remotely, the presence of reliable customer support becomes extremely important. Whether you are navigating the loan application process or managing repayments, having access to prompt customer support channels is essential for addressing queries and resolving issues.

Before committing to an online lender, it is crucial to assess the availability and responsiveness of its customer support channels. Look for platforms that offer multiple communication channels, such as email or live chat, to accommodate diverse preferences. A robust customer support system demonstrates the lender’s commitment to providing assistance and guidance to borrowers throughout their loan journey. A prompt and knowledgeable response helps to foster trust and transparency in the borrower-lender relationship.

9. Security Measures

In an era where cyber threats are looming everywhere, safeguarding personal and financial information is of utmost importance, especially when engaging in online financial transactions. As such, it is important to prioritize security when selecting an online lending platform. Robust security measures not only protect sensitive data from unauthorized access but also instill confidence in borrowers.

One of the fundamental aspects to scrutinize when assessing the security of an online lending platform is the implementation of SSL encryption. Secure Socket Layer (SSL) encryption encrypts data transmitted between the borrower’s device and the lender’s website. Data remains confidential and secure from interception by malicious actors. Additionally, look for platforms that employ secure payment gateways which can prevent unauthorized access during the transaction process. By prioritizing platforms with robust security measures, borrowers can mitigate the risk of data breaches and protect their personal and financial information from cyber threats.

10. Compare Multiple Options

When it comes to choosing an online lending platform for your personal loan needs, it is essential not to rush into a decision hastily. Instead, take the time to explore and compare multiple options to find the one that best aligns with your financial goals and requirements. Each online lending platform may offer different terms, interest rates, and features. By conducting a thorough comparison, you can make an informed decision that suits your circumstances.

However, in the process of comparing multiple options, it is crucial to remain vigilant and beware of potential scammers. Unfortunately, the online lending space is not immune to malicious actors seeking to exploit borrowers. Therefore, as you evaluate different platforms, be sure to verify their credibility and regulatory compliance to avoid falling victim to scams. Look for red flags such as unrealistic offers, unprofessional website designs, or requests for sensitive information without proper security protocols in place. By exercising caution and conducting due diligence, you can protect yourself from potential scams and confidently select a reputable online lending platform that meets your needs.

Conclusion

Applying for a personal loan online in Malaysia offers unparalleled convenience, but it demands careful consideration of various factors. By considering the factors above, borrowers can navigate the online lending landscape with confidence. Remember to thoroughly research and compare options to find the most suitable online personal loan that aligns with your goals.