Managing Your Finances Post-Festive Season in Malaysia

The festive seasons in Malaysia are joyous occasions filled with family gatherings, mouth-watering feasts, and generous gift-giving. However, the aftermath of these celebrations often leaves many individuals facing financial challenges due to overspending. As the festivities wind down, it is crucial to take proactive steps to regain financial stability and plan for the months ahead.

Assessing the Damage

After enjoying the excitement during the festive season, it is time to confront the financial aftermath head-on. Start by carefully reviewing your bank statements, credit card bills, and any other financial documents. This comprehensive analysis will provide a clear picture of your spending during the festivities. By scrutinizing each expense, you can identify areas where you may have spent excessively or overlooked budgetary constraints.

Once you have compiled an assessment of your post-festive season finances, it is crucial to pinpoint areas for potential adjustment. This could involve identifying unnecessary expenses and reallocating funds to cover essential costs. By acknowledging where overspending occurred, you can proactively address these areas and implement strategies to prevent similar financial pitfalls in the future.

Remember, regaining control of your finances after the festive season is a gradual process that requires diligence and discipline. Use the insights gained from your financial assessment to inform your budgeting and spending decisions moving forward. By taking proactive steps to mitigate overspending and making necessary adjustments, you can set yourself on a path toward financial stability and peace of mind.

Creating a Roadmap for Financial Recovery

Creating a budget post-festive season is akin to crafting a financial roadmap toward recovery. Start by identifying your essential expenses, such as rent or mortgage payments, utilities, groceries, and transportation costs. These are non-negotiable expenditures that must be prioritized to ensure your basic needs are met.

Additionally, it is important to address any outstanding debts accrued during the festive season celebrations. Whether it is credit card balances, personal loans, or deferred payments, tackling these financial obligations quickly is crucial to avoid accruing interest charges. Allocate a portion of your income specifically towards debt repayment. You should prioritize high-interest debts first to minimize long-term financial strain. For example, if you spent a huge amount in credit card debt during the festival shopping, committing to paying off a set amount each month can expedite the repayment process and alleviate financial burdens.

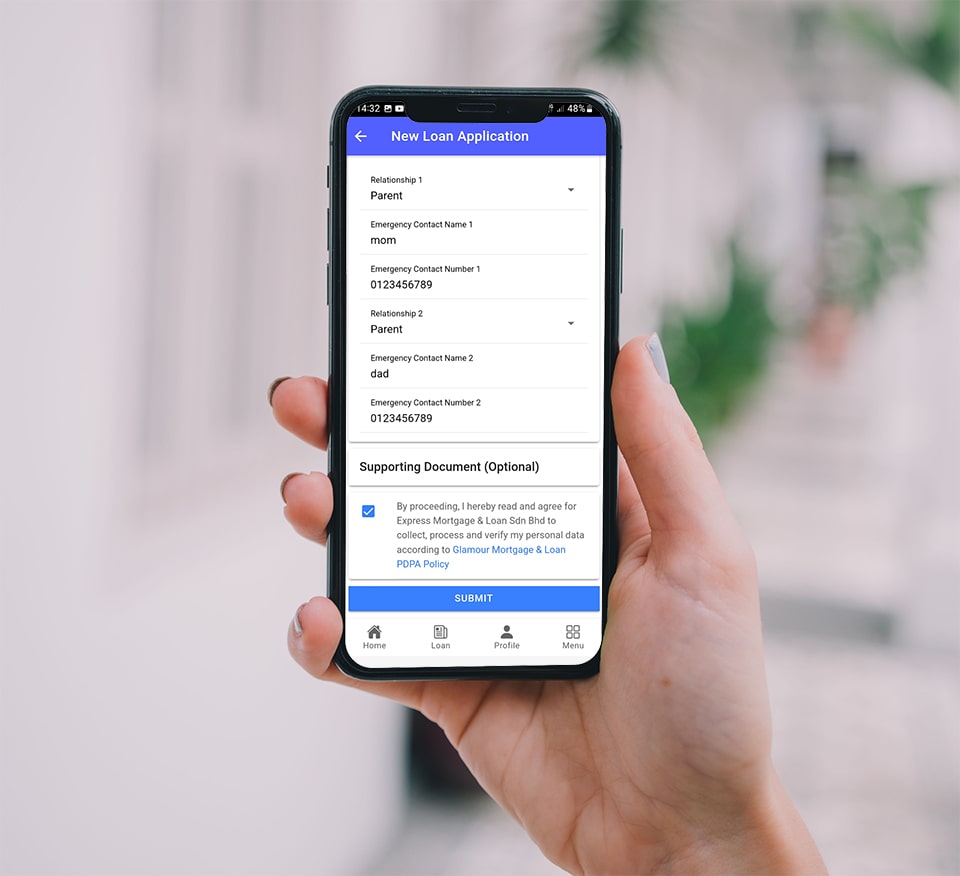

To facilitate effective budget management and track your progress toward financial recovery, consider utilizing budgeting tools or apps. These digital resources offer features such as expense tracking, budget customization, and financial goal setting. These tools allow us to stay organized and accountable. By using the tools, we can categorize expenses, set spending limits, and receive real-time insights into our financial habits. By leveraging technology to streamline your budgeting process, you can proactively manage your finances and achieve your post-festive season recovery goals with confidence.

Exploring Financial Assistance

For individuals facing significant financial strain post-festive season, exploring financial assistance options such as micro loans can provide much-needed relief. Micro loans, characterized by their small loan amounts and short repayment periods, can be an effective solution when managed responsibly. Here are some of the planning steps for micro loans.

1. Assess Your Needs

Before applying for a micro loan, it is important to assess your financial needs. Determine the specific purpose for the loan, whether it is consolidating debts or covering unexpected expenses such as car repair after the festive season. By understanding your objectives, you can ensure that you borrow responsibly and avoid unnecessary financial strain.

Once you have identified your needs, carefully evaluate the amount of funding required. Consider factors such as outstanding balances, upcoming expenses, and your repayment capacity. Analyze your income and expenses to determine how much you can realistically afford to repay each month. Additionally, explore alternative solutions or financial assistance programs that may better suit your situation before committing to a micro loan. This approach ensures that you make an informed decision that aligns with your long-term financial goals.

2. Research Lenders

When researching lenders for micro loans in Malaysia, it is important to prioritize institutions that adhere to regulatory standards set by governing bodies like Bank Negara Malaysia (BNM) for banks and the Ministry of Housing and Local Government (KPKT) for non-bank personal loan providers. Start by exploring reputable financial institutions which offer micro loans with competitive interest rates and favorable repayment terms. Look for institutions that have a solid track record of providing transparent lending practices and excellent customer service.

Additionally, consider alternative lending options such as registered personal loan providers like EM Loan, which operate under the supervision of KPKT. These providers offer flexibility and accessibility, catering to individuals who may not meet the stringent eligibility criteria set by traditional banks or larger institutions. Compare interest rates, repayment terms, and eligibility criteria among various lenders to find the best fit for your circumstances. Look for lenders that offer competitive rates, flexible repayment options, and clear terms and conditions to ensure a positive borrowing experience.

3. Create a Repayment Plan

Developing a realistic repayment plan for your micro loan is essential to ensure financial stability and avoid unnecessary debt burdens. Start by assessing your budget and income to determine how much you can comfortably allocate towards loan repayment each month. Prioritize repaying the micro loan over other discretionary expenses to avoid accumulating additional interest and fees. Consider setting up automatic payments or reminders to ensure timely repayment and avoid missing deadlines.

4. Borrow Responsibly

Borrow responsibly by only taking out loans that you can comfortably repay within the specified timeframe. Avoid the temptation to acquire multiple micro loans simultaneously, as this may result in financial strain and make it challenging to manage repayments effectively. Prioritize prudent borrowing practices to maintain financial stability and avoid unnecessary debt burdens.

Seeking Financial Guidance

If you are having problems dealing with post-festive season financial challenges, seeking guidance from financial advisors or counselors can provide invaluable support. These professionals are equipped with the expertise and resources to help you navigate through financial difficulties effectively. Whether you are struggling with debt management, budgeting, or planning for the future, financial advisors can offer personalized advice tailored to your specific needs.

Many organizations and institutions offer free or low-cost financial planning services to individuals seeking assistance. From government agencies to non-profit organizations and community centers, there are numerous resources available to help you regain control of your finances. Take advantage of workshops, seminars, and one-on-one counseling sessions to gain insights into effective financial management strategies and develop a plan for achieving your financial goals. Remember, seeking financial guidance is not a sign of weakness but a proactive step towards securing your financial future.

Conclusion

While the festive season is a time of celebration and joy, it is important to approach post-celebration finances with caution and foresight. By assessing your financial situation, creating a budget, exploring financial assistance options such as micro loans, and seeking guidance when needed, you can regain control of your finances and pave the way for a more secure financial future. Remember, proper planning and responsible financial management are key to achieving long-term financial stability and peace of mind.