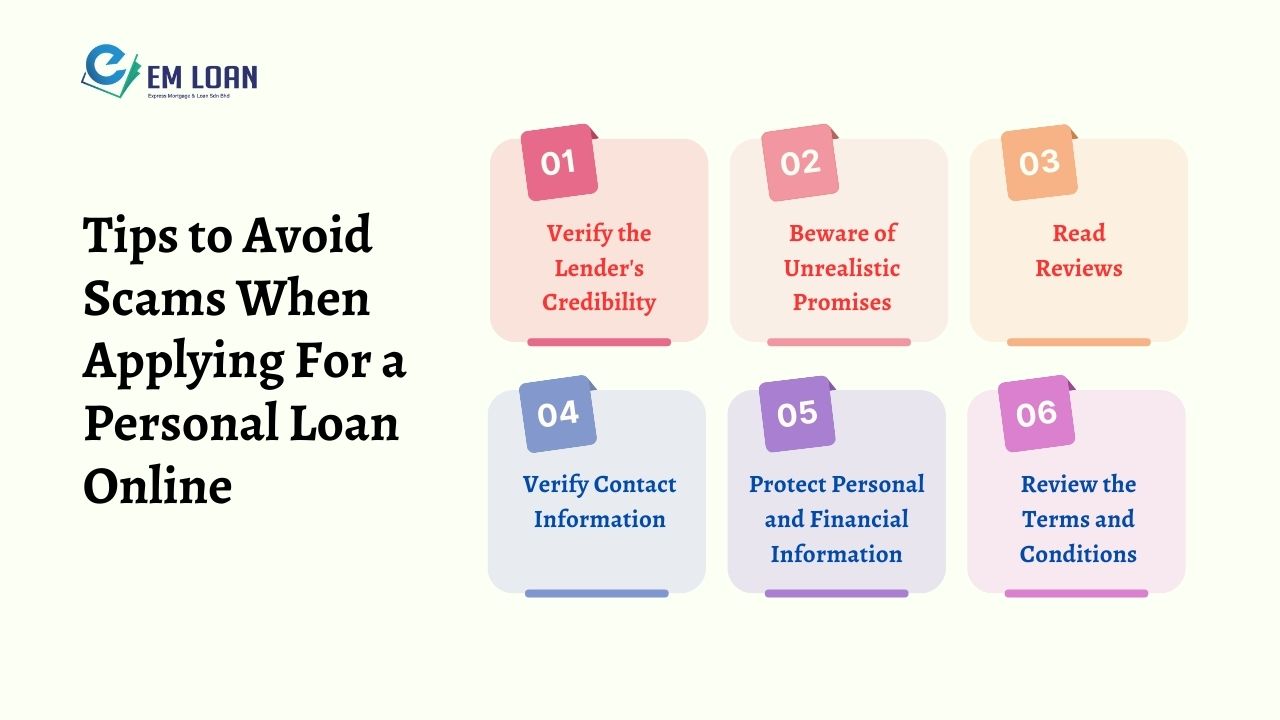

Top 6 Tips to Avoid Scams When Applying For a Personal Loan Online in Malaysia

As the popularity of online financial services grows in Malaysia, the risk of encountering scams and fraudulent activities is increasing too. This is extremely true, particularly in the realm of online loan applications. Scammers often prey on individuals seeking quick and convenient access to funds. This is the reason why borrowers should arm themselves with knowledge and caution. In this article, we will explore the top 6 tips to help Malaysians avoid falling victim to scams when applying for a personal loan online.

1. Verify the Lender's Credibility

Before committing to an online lending platform, invest time in conducting comprehensive research to assess its credibility. Verify if the lender is registered with regulatory authorities such as Bank Negara Malaysia (BNM) and the Ministry of Housing and Local Government (KPKT). If the lender is a bank, registration with BNM ensures that the bank operates within the legal framework. Additionally, for non-bank credit providers, it is important to check if they are licensed by KPKT. This licensing requirement ensures that the lender complies with regulations specific to credit provision, further validating their legitimacy. By confirming the lender’s registration or licensing status, borrowers mitigate the risk of falling prey to unauthorized entities and lay a solid foundation for a secure borrowing experience.

Scammers often exploit the anonymity and accessibility of online platforms to perpetrate fraudulent activities. They like to target unsuspecting borrowers seeking financial assistance. Verifying the legitimacy of the lender serves as the first line of defense against potential fraud. Beyond regulatory checks, delve into customer reviews to gauge the lender’s reputation. By combining regulatory validation with insights from previous borrowers, individuals can make informed decisions and choose reputable online lending platforms that prioritize transparency and integrity.

2. Beware of Unrealistic Promises

Online lenders who make unrealistic promises should raise immediate suspicion among borrowers. Extravagant promises may include instant approval without conducting a credit check and guaranteed loan approval. Legitimate lenders must adhere to responsible lending practices. They need to assess borrowers’ creditworthiness and financial situations before approving loans. Offers that seem too good to be true often serve as warning signs of potential fraudulent schemes orchestrated to exploit unsuspecting borrowers in dire financial need.

These unrealistic promises often prey on individuals facing urgent financial situations or struggling with poor credit histories. False hope and quick solutions are offered to lure victims in. However, behind these offers lie hidden agendas aimed at extracting high fees, imposing predatory interest rates, or even perpetrating identity theft. It is essential for borrowers to exercise caution and skepticism when encountering such offers. By remaining vigilant and discerning, borrowers can safeguard themselves from falling victim to fraudulent schemes.

3. Read Reviews

When navigating the landscape of online lending, seeking recommendations from trusted sources or people who have firsthand experience with reputable online lenders can provide invaluable insights. Friends or family members who have successfully obtained personal loans from online lenders can offer valuable recommendations based on their experiences. For example, if a close friend recently secured an online loan and had a positive experience, his endorsement can carry significant weight in guiding your decision-making process.

In addition to seeking recommendations, reading reviews and testimonials from previous borrowers can offer further clarity on the lender’s reputation. Platforms such as Trustpilot and Google Reviews often feature user-generated feedback and ratings for various online lenders. By studying these reviews, you can gain insights into the lender’s customer service quality and overall borrower satisfaction levels. For example, positive reviews praising a lender’s transparent loan terms and hassle-free application process can instill confidence in prospective borrowers.

4. Verify Contact Information and Customer Support

Before proceeding with any online lender, it is essential to verify the authenticity of their contact information and the responsiveness of their customer support channels. Legitimate lenders prioritize transparency and accessibility, providing borrowers with valid contact details such as phone numbers and email addresses. Take the initiative to reach out to the lender via these channels to assess their responsiveness. Prompt and courteous responses indicate a commitment to customer service excellence. It can instill confidence in borrowers regarding the lender’s accountability.

Scammers often employ deceptive tactics by using fake or non-existent contact details to conceal their fraudulent activities. By attempting to contact the lender through various channels, borrowers can detect red flags such as unanswered calls and bounced emails. Additionally, conducting a quick online search or checking review platforms for feedback regarding the lender’s customer support can provide further insights into their reliability. Legitimate lenders prioritize open communication and are readily available to address borrower inquiries.

5. Protect Personal and Financial Information

The protection of personal and financial information is paramount when engaging in online transactions, especially when applying for a personal loan. To safeguard sensitive data from unauthorized access or misuse, it is important to exercise caution and adhere to stringent security practices. Legitimate lenders employ robust measures such as SSL encryption to encrypt information transmitted between the borrower’s device and the lender’s website. This encryption technology ensures that sensitive data, including personal identification details and financial credentials, remains confidential and secure.

In addition to SSL encryption, reputable lenders utilize secure payment gateways to facilitate safe transactions. These payment gateways employ advanced encryption protocols and authentication mechanisms to protect payment information from tampering. By leveraging these secure channels, borrowers can confidently provide payment details. Furthermore, borrowers should exercise vigilance and refrain from sharing sensitive information with unknown parties. Sensitive information can include MyKad numbers, banking details, or passwords. By adhering to these security practices, borrowers can fortify their defenses against identity theft, fraud, and other cybersecurity risks, ensuring a safe online lending experience.

6. Review the Terms and Conditions

Reviewing the terms and conditions of a loan agreement is important to ensure a secure borrowing experience. A careful examination allows borrowers to identify any potential red flags that may indicate fraudulent practices. For example, legitimate lenders typically disclose all fees upfront, including origination fees, late payment penalties, and prepayment charges. Conversely, scammers may attempt to conceal hidden fees or impose excessive charges. High processing fees or undisclosed administrative costs can significantly inflate the overall cost of borrowing.

In addition to hidden fees, borrowers should be wary of excessively high-interest rates or suspicious clauses that could lead to financial harm. Scammers may exploit borrowers by imposing predatory interest rates that far exceed industry standards. Pay attention to ambiguous clauses that could be interpreted to the lender’s advantage. For example, clauses that grant the lender unilateral discretion to modify terms or impose additional charges without prior notice should raise concerns. By scrutinizing the terms and conditions, borrowers can protect themselves from potential scams and make informed decisions regarding their financial obligations.

Conclusion

Applying for a personal loan online offers convenience, but it also requires caution to avoid scams and fraudulent activities. By adhering to the tips outlined in this article and exercising due diligence throughout the loan application process, Malaysians can safeguard themselves against potential scams. Remember, if something seems too good to be true, it likely is. It is always better to be cautious when dealing with online financial transactions.

Introducing EM Loan, a reputable online personal loan provider licensed by the Ministry of Housing and Local Government (KPKT), committed to providing accessible and transparent financial solutions to borrowers in Malaysia. If you would like to know more about how EM Loan can assist you on your online lending journey, feel free to reach out to us.